does wyoming have taxes

There are no taxes on your personal income. Wyoming has very low property taxes compared to other states.

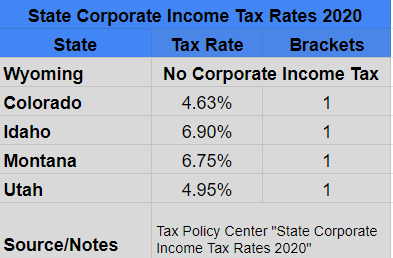

State Corporate Income Tax Rates And Brackets Tax Foundation

Education and Taxability Taxability Specialists in this section answer the myriad of questions which vendors and taxpayers have regarding how the various taxes and exemptions.

. The states sales tax rate is 40. Wyoming may be the most tax-friendly state south of Alaska. There is a federal estate tax that may.

Mortgage Calculator Rent vs Buy. Wyomings average effective property tax rate is also on the low side ranking as the 10th-lowest in the country. There is no estate tax in Wyoming.

Wyoming does not levy an inheritance tax or an estate tax. Wyoming also does not have a corporate income tax. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000.

Wyoming does not have an individual income tax. The state and average local sales tax rate is 534. It does not have its own income tax which means all forms of retirement income will not be taxed at the state level.

It is normal for the tax rate to be above 6 percent even if additional taxes have been added in different counties or municipalities. As of 2021 Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming are the only states that do not levy a state income tax. Up to 25 cash back As just mentioned Wyoming is one of just a few states that have neither a corporate income tax nor a personal income tax.

NO TAX ON MINERAL OWNERSHIP. Although we are not tax or legal professionals weve helped form a lot businesses and want to share our knowledge and experience. What Taxes Do Businesses Pay In Wyoming.

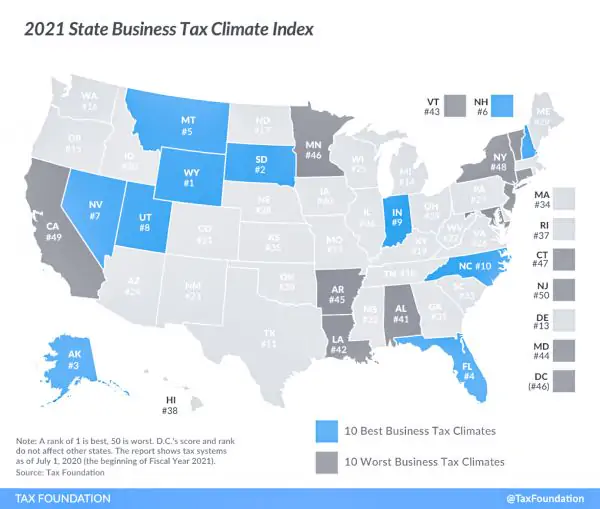

1 Note that Washington does levy a state. Many states charge owners a tax. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index.

Wyoming has no state income tax. Overview Of Wyoming Taxes. At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2.

25 minutes agoDuring the work session Monday Wyoming city staff presented council with three potential property tax increase options the public body could put on the November 2022 or May 2023 ballot. The taxes that you do pay here are based on the assessed value of the property. Wyomings corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Wyoming.

However if you are inheriting property from another state that state may have an estate or inheritance tax that applies. Counties in Wyoming collect an average of 058 of a propertys assesed fair market value as property tax per year. In fact with the possible exception of South Dakota Wyoming may be the most income tax-friendly state in the country.

Wyoming has no estate or inheritance tax. Wyoming Sales Tax Rates Wyoming does have sales tax. Corporations are not subject to entity taxes.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. The Wyoming corporate income tax is the business equivalent of the Wyoming personal income tax and is based on a bracketed tax system. The average effective property tax rate in Wyoming is just 057.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. In the United States state sales taxes are only 4 percent. Similar to the personal income tax businesses must file a yearly tax.

It is one of 38 states in the country that does not levy a tax on estates. Insure that all new vendors are offered a face to face visit from our field representatives to discuss their new business and how they might be affected by our taxes. When you fill up your car with gas or buy a bag of groceries in Wyoming you will not pay any state tax on your gas or food.

Wyoming Income Tax Calculator Smartasset

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How Does Wyoming S Tax Structure Compare To Other States Wyofile

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

7 States Without Income Tax Mintlife Blog

Wyoming Sales Tax Small Business Guide Truic

The States With The Highest Capital Gains Tax Rates The Motley Fool

States With Highest And Lowest Sales Tax Rates

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With No Income Tax H R Block

The Most And Least Tax Friendly Us States

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Fashions Itself As Tax Haven For World S Rich Report

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Tax Benefits Of Buying A Home In Jackson Hole Wyoming Wyoming Home Buying Inheritance Tax